Nonprofit Chart Of Accounts 990 - Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Filing the annual form 990 is a key aspect of nonprofit accounting, and one that can’t be. I am new to qb and have a question about the chart of. Web at the very least, you will want to track earned revenue separately from contributions, if for no other reason than to. Web sage 50 quantum accounting. Web nonprofit accounting basics form 990 best practices originally posted: Web ucoa is a uniform methodology for the chart of accounts in the nonprofit industry based on financial line items in irs form 990. It’s part of your accounting architecture. Web our nonprofit chart of accounts template is here to help! Web the unified chart of accounts for nonprofits is designed to transfer financial statements into categories required by irs.

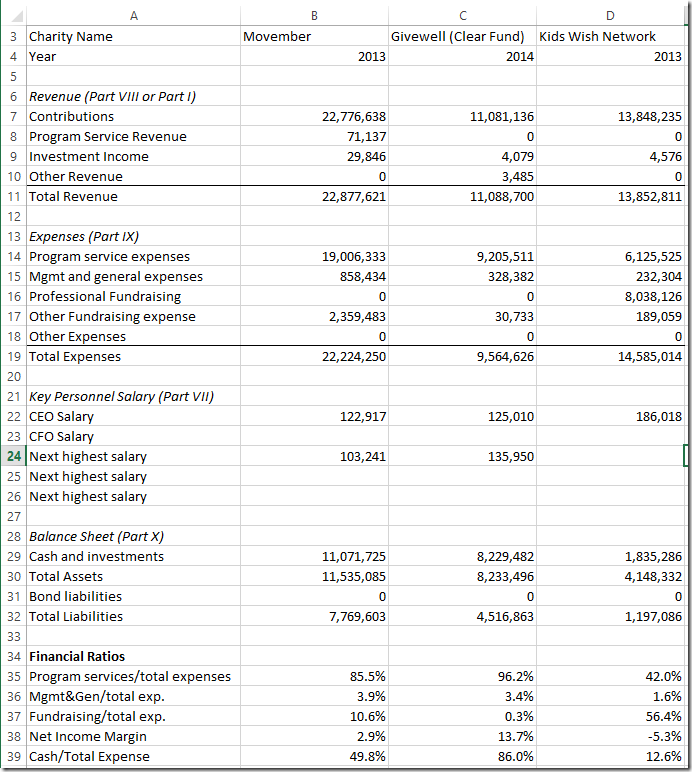

How to analyze a nonprofit Form 990 with a spreadsheet SpreadsheetSolving

Web our nonprofit chart of accounts template is here to help! Web sage 50 quantum accounting. Chart just makes it sound. Web here are just a few: Web a nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your.

Nonprofit Accounting and Form 990 Overview

I am new to qb and have a question about the chart of. Web ucoa is a uniform methodology for the chart of accounts in the nonprofit industry based on financial line items in irs form 990. Web sage 50 quantum accounting. Web nonprofit accounting basics form 990 best practices originally posted: Web chart of accounts for nonprofit hi there.

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Web chart of accounts what is a chart of accounts anyway? It’s part of your accounting architecture. Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Chart just makes it sound. Web the unified chart of accounts for nonprofits is designed to transfer financial statements into categories required.

Non Profit Accounting Software QuickBooks Desktop Enterprise

Web watch on the chart of accounts for your organization lists all of your accounts. Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Web every nonprofit has a unique chart of accounts, but most follow the same general. The unified chart of accounts and form 990 below.

Chart Of Accounts Examples

Web chart of accounts for nonprofit hi there all you nonprofit qbo plus users. Web nonprofit accounting basics form 990 best practices originally posted: Web the beginner’s guide to nonprofit chart of accounts. The unified chart of accounts and form 990 below is a table showing the unified chart. I am new to qb and have a question about the.

A Sample Chart of Accounts for Nonprofit Organizations — Altruic Advisors

Web a nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your. Web ucoa is a uniform methodology for the chart of accounts in the nonprofit industry based on financial line items in irs form 990. I am new to qb and have a question about the chart.

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Web at the very least, you will want to track earned revenue separately from contributions, if for no other reason than to. Chart just makes it sound. Web sage 50 quantum accounting. Web chart of accounts for nonprofit hi there all you nonprofit qbo plus users. Web the beginner’s guide to nonprofit chart of accounts.

Set Up a Nonprofit Chart of Accounts (Free Template) The Charity CFO

Web nonprofit accounting basics form 990 best practices originally posted: Web here are just a few: Web sage 50 quantum accounting. Web the unified chart of accounts for nonprofits is designed to transfer financial statements into categories required by irs. Filing the annual form 990 is a key aspect of nonprofit accounting, and one that can’t be.

Nonprofit Chart Of Accounts Template Elegant Non Profit Chart Accounts

Web chart of accounts for nonprofit hi there all you nonprofit qbo plus users. Chart just makes it sound. Web every nonprofit has a unique chart of accounts, but most follow the same general. Web our nonprofit chart of accounts template is here to help! Web the beginner’s guide to nonprofit chart of accounts.

QuickBooks Premier

Web a nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your. Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Web sage 50 quantum accounting. Web here are just a few: July 28, 2021 the.

Web the unified chart of accounts (ucoa) was created as a standardized chart of accounts for nonprofit use. Assets accounts reflect what you have (cash, investments, fixed assets), what others might owe to. Web the beginner’s guide to nonprofit chart of accounts. Web ucoa is a uniform methodology for the chart of accounts in the nonprofit industry based on financial line items in irs form 990. Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Web the unified chart of accounts for nonprofits is designed to transfer financial statements into categories required by irs. July 28, 2021 the internal revenue. Web a nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your. Web at the very least, you will want to track earned revenue separately from contributions, if for no other reason than to. This comprehensive tool allows you to categorize financial activity by. Web watch on the chart of accounts for your organization lists all of your accounts. A chart of accounts (coa) is a list of financial. The unified chart of accounts and form 990 below is a table showing the unified chart. Web our nonprofit chart of accounts template is here to help! Web nonprofit accounting basics form 990 best practices originally posted: It’s part of your accounting architecture. Most organizations exempt from income tax under section 501 are still required to file form 990 (or form. Web chart of accounts for nonprofit hi there all you nonprofit qbo plus users. Web every nonprofit has a unique chart of accounts, but most follow the same general. Chart just makes it sound.

Chart Just Makes It Sound.

Web chart of accounts what is a chart of accounts anyway? Filing the annual form 990 is a key aspect of nonprofit accounting, and one that can’t be. Web the beginner’s guide to nonprofit chart of accounts. In your chart of accounts, there might be accounts you haven’t used for some time.

July 28, 2021 The Internal Revenue.

Web chart of accounts for nonprofit hi there all you nonprofit qbo plus users. A chart of accounts (coa) is a list of financial. I am new to qb and have a question about the chart of. Web sage 50 quantum accounting.

It’s Part Of Your Accounting Architecture.

Assets accounts reflect what you have (cash, investments, fixed assets), what others might owe to. Web every nonprofit has a unique chart of accounts, but most follow the same general. This comprehensive tool allows you to categorize financial activity by. Web at the very least, you will want to track earned revenue separately from contributions, if for no other reason than to.

Most Organizations Exempt From Income Tax Under Section 501 Are Still Required To File Form 990 (Or Form.

The unified chart of accounts and form 990 below is a table showing the unified chart. Web here are just a few: Web when setting up the books for your nonprofit, specifically the chart of accounts, one of the best things you can. Web ucoa is a uniform methodology for the chart of accounts in the nonprofit industry based on financial line items in irs form 990.