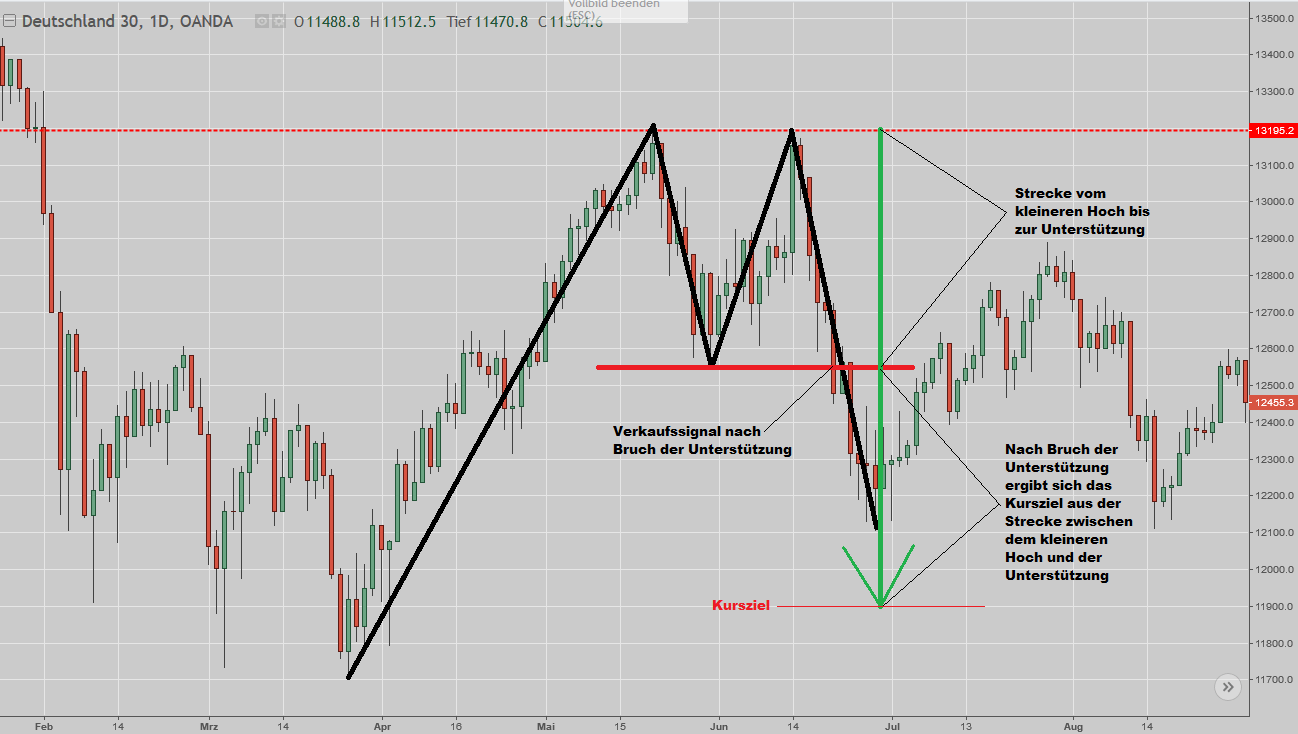

M Pattern Chart - Web a double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. M pattern is a bearish reversal pattern. The m pattern is a technical chart pattern that resembles the letter “m.” it typically occurs during a downtrend and signifies a potential reversal to an uptrend. Web updated with new statistics on 8/25/2020. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the. Web look for a double top reversal pattern at the top of the big m. The left side of the big m should be a tall, straight rise. Patterns are the distinctive formations created by the movements of security prices on a chart. These patterns are named after the shape they. Web the ''m'' and ''w'' trading pattern is a great little pattern that occurs with enough frequency for you to add it to your trading tool bag.

Double Top (M) Chart Pattern for NSENIFTY by PrasantaP — TradingView India

M pattern is a bearish reversal pattern. Work 7 rows of (k1, p1) to last stitch, k1. However, to be confident with the structure, you need to see the movement. These patterns can provide traders with. The left side of the big m should be a tall, straight rise.

24 Stock Chart Patterns Explained With Simple Diagrams Netcials

This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone. The big m chart pattern is a double top with tall sides. Web australia has voted no in the referendum, but the vote hasn't been uniform across states and cities..

Was ist ein Doppeltop (MFormation)? TradingTreff

S&p 500 index (us500 cfd) chart by tradingview. The m chart pattern is a reversal pattern that is bearish. These patterns can provide traders with. Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. It is also called the double top pattern.

Merrill patterns MQL5 Articles

But if you want to know when to buy. Web the pattern is created by two successive higher lows followed by a higher high. M pattern is a bearish reversal pattern. Web a double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. Web s&p 500 index:

The M and W Pattern YouTube

The w pattern is considered confirmed once the. However, to be confident with the structure, you need to see the movement. K1, p1, k1, p1, k37, p1, k1, p1, k1. Web understanding the m pattern. Web updated with new statistics on 8/25/2020.

M Forex Pattern Fast Scalping Forex Hedge Fund

S&p 500 index (us500 cfd) chart by tradingview. But if you want to know when to buy. Web the m and w patterns are two popular chart patterns in forex trading. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level.

The Big M Chart Pattern

The master pattern indicator is derived from the framework proposed by wyckoff and automatically displays. However, to be confident with the structure, you need to see the movement. M pattern is a bearish reversal pattern. But if you want to know when to buy. Felix richter , oct 13, 2023.

M pattern and W pattern

Web a double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. It is also called the double top pattern. But if you want to know when to buy. Web updated with new statistics on 8/25/2020. Felix richter , oct 13, 2023.

M and W Patterns Technical Resources

Web after losing some value lately, a hammer chart pattern has been formed for walmart (wmt), indicating that the stock. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the. Web m and w patterns look for chart patterns that have price action that looks like an m/w.

M pattern Breakout for NSEUBL by stocksivaram — TradingView India

Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. Patterns are the distinctive formations created by the movements of security prices on a chart. The m chart pattern is a reversal pattern that is bearish. Web look for a double top reversal pattern at the top of the big m. Web.

The w pattern is considered confirmed once the. The reserve bank of india fined. Web after losing some value lately, a hammer chart pattern has been formed for walmart (wmt), indicating that the stock. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the. These patterns are named after the shape they. Web the nifty bank index share price continued retreated on wednesday as concerns about the banking industry. Web s&p 500 index: Web a compelling technical pattern has emerged, signaling the coin's strength and potential for a sustained bullish trend. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone. Web the pattern is created by two successive higher lows followed by a higher high. However, to be confident with the structure, you need to see the movement. The m chart pattern is a reversal pattern that is bearish. These patterns can provide traders with. The big m chart pattern is a double top with tall sides. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. Web australia has voted no in the referendum, but the vote hasn't been uniform across states and cities. Web look for a double top reversal pattern at the top of the big m. Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. Work one more even row. The pattern looks like an m.

The Reserve Bank Of India Fined.

Web updated with new statistics on 8/25/2020. S&p 500 index (us500 cfd) chart by tradingview. The m pattern is a technical chart pattern that resembles the letter “m.” it typically occurs during a downtrend and signifies a potential reversal to an uptrend. Patterns are the distinctive formations created by the movements of security prices on a chart.

However, To Be Confident With The Structure, You Need To See The Movement.

But if you want to know when to buy. Web a double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the. The big m chart pattern is a double top with tall sides.

M Pattern Is A Bearish Reversal Pattern.

The pattern looks like an m. Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. Web s&p 500 index:

K1, P1, K1, P1, K37, P1, K1, P1, K1.

Work one more even row. Web australia has voted no in the referendum, but the vote hasn't been uniform across states and cities. Web after losing some value lately, a hammer chart pattern has been formed for walmart (wmt), indicating that the stock. Work 7 rows of (k1, p1) to last stitch, k1.